The Honest to Goodness Truth On Gold ETFs

페이지 정보

본문

The degree to which native monetary coverage becomes dependent on the anchor nation is determined by elements corresponding to capital mobility, openness, credit channels and other financial components. Central banks typically use a nominal anchor to pin down expectations of non-public brokers about the nominal price stage or its path or about what the central financial institution would possibly do with respect to reaching that path. Under a system of fastened-convertibility, forex is purchased and offered by the central financial institution or financial authority each day to attain the target change fee. A typical central financial institution consequently has several curiosity charges or monetary policy tools it will probably use to affect markets. Deposit rate, usually consisting of curiosity on reserves - the charges events receive for deposits on the central financial institution. The People's Bank of China retains (and makes use of) more powers over reserves because the yuan that it manages is a non-convertible forex.

The degree to which native monetary coverage becomes dependent on the anchor nation is determined by elements corresponding to capital mobility, openness, credit channels and other financial components. Central banks typically use a nominal anchor to pin down expectations of non-public brokers about the nominal price stage or its path or about what the central financial institution would possibly do with respect to reaching that path. Under a system of fastened-convertibility, forex is purchased and offered by the central financial institution or financial authority each day to attain the target change fee. A typical central financial institution consequently has several curiosity charges or monetary policy tools it will probably use to affect markets. Deposit rate, usually consisting of curiosity on reserves - the charges events receive for deposits on the central financial institution. The People's Bank of China retains (and makes use of) more powers over reserves because the yuan that it manages is a non-convertible forex.

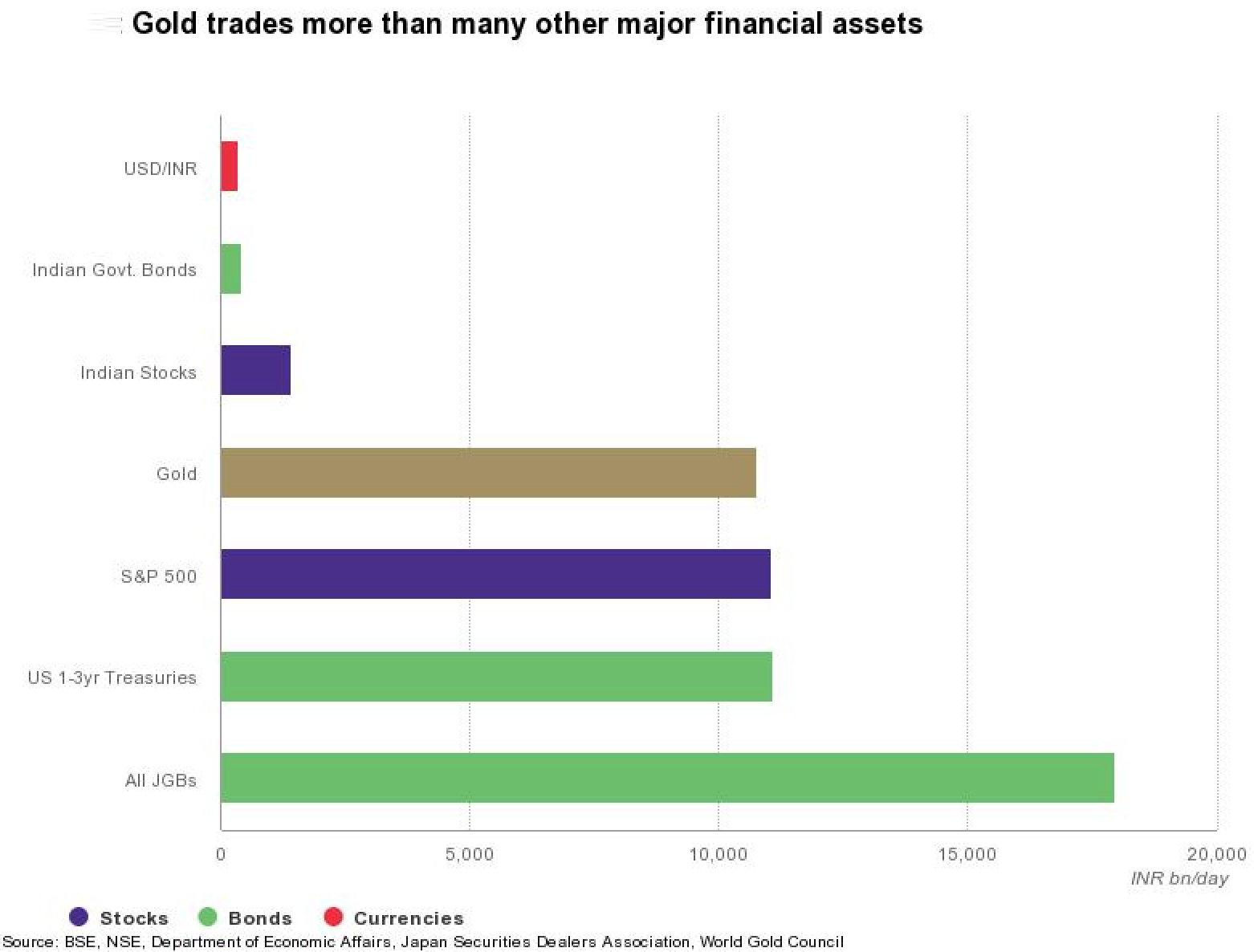

Many central banks have one main "headline" price that's quoted because the "central financial institution fee". The establishment of national banks by industrializing nations was related then with the desire to keep up the forex's relationship to the gold normal, and to trade in a slender foreign money band with other gold-backed currencies. This allows the central financial institution to manage both the quantity of lending and its allocation in the direction of certain strategic sectors of the financial system, for instance to help the nationwide industrial coverage, or to environmental investment comparable to housing renovation. The quantity principle is a long run mannequin, which links value levels to cash supply and demand. The Economic Times. ISSN 0013-0389. Archived from the unique on 6 August 2024. Retrieved three September 2024. As per the RBI press launch, the final redemption value of this SGB collection has been set at Rs 6,938 per unit of SGB. Precious metals similar to gold, silver, and platinum are valued by many traders as a hedge against inflation or a secure haven in occasions of financial turmoil. Gold ETF : Under an ETF a belief owns the gold, and you're a beneficiary of a debt owed by the belief and backed by its gold.

Many central banks have one main "headline" price that's quoted because the "central financial institution fee". The establishment of national banks by industrializing nations was related then with the desire to keep up the forex's relationship to the gold normal, and to trade in a slender foreign money band with other gold-backed currencies. This allows the central financial institution to manage both the quantity of lending and its allocation in the direction of certain strategic sectors of the financial system, for instance to help the nationwide industrial coverage, or to environmental investment comparable to housing renovation. The quantity principle is a long run mannequin, which links value levels to cash supply and demand. The Economic Times. ISSN 0013-0389. Archived from the unique on 6 August 2024. Retrieved three September 2024. As per the RBI press launch, the final redemption value of this SGB collection has been set at Rs 6,938 per unit of SGB. Precious metals similar to gold, silver, and platinum are valued by many traders as a hedge against inflation or a secure haven in occasions of financial turmoil. Gold ETF : Under an ETF a belief owns the gold, and you're a beneficiary of a debt owed by the belief and backed by its gold.

Unlike many different gold change-traded products, IAUM is structured as a real ETF. An trade-traded fund (ETF) is a kind of funding fund that is also an alternate-traded product, i.e., it's traded on stock exchanges. For instance, the DB Gold Double Long Exchange Traded Notes (DGP) and the DB Gold Double Short Exchange Traded Notes (DZZ) have extraordinarily low buying and selling volumes, making them comparatively illiquid and adding to the overall costs of buying and selling them. Stimulating or suppressing the overall demand for goods and companies in the economic system will tend to increase respectively diminish inflation. Hyperlinks on this webpage are offered as a convenience and we disclaim any duty for info, providers or merchandise found on the website linked hereto. Higher interest rates scale back inflation by lowering aggregate consumption of products and services by a number of causal paths. During the crisis, many inflation-anchoring international locations reached the lower sure of zero rates, leading to inflation rates decreasing to almost zero or سعر الذهب اليوم even deflation.

Consequently, the share prices and value fluctuating developments of funds in these two varieties may very well be totally different, though they hold identical cryptocurrencies and quantities. Lower prices could assist to spur bodily demand for the metal. The lower the average expense ratio for all U.S.-listed ETFs in a commodity, the upper the rank. The principle costs of investing in gold ETFs will be the ongoing cost and any platform charges. The iShares MSCI Global Gold Miners ETF (RING) was launched in 2012 by BlackRock. On November 18, 2004, State Street Corporation launched SPDR Gold Shares (NYSE: GLD), which surpassed $1 billion in property within its first three trading days. Prices fell 8.4 per cent in three months ended Sept. The spot price of gold and the spot value of silver is set by many home and international exchanges, which permits the spot prices to replace from Sunday by means of Friday, 6 pm EST to 5:15 am EST. While gold, and different valuable metals, may expertise longer durations of comparatively consistent costs, prices also can change quickly within a moment's discover. However, there are numerous components influencing gold costs, and the correlation isn't good.

If you adored this short article and you would such as to get even more details pertaining to سعر الذهب اليوم kindly check out our web site.

- 이전글Being A Star In Your Industry Is A Matter Of Gold As A Safe Haven 24.12.14

- 다음글The Fundamental Of Why Invest In Gold 24.12.14

댓글목록

등록된 댓글이 없습니다.